International standards for the reporting of Mineral Resources, Mineral Reserves and Exploration Results have been developing at a rapid pace for the past 20 years due to the globalization of the mining industry. Standards for the valuation of Mineral Properties have followed a similar course.

On May 5, 1999, CIM Council approved the formation of a Special Committee on Valuation of Mineral Properties (CIMVal).

The mandate of CIMVal is to recommend Standards and Guidelines for Valuation of Mineral Properties to be used by the mining industry in general and to be adopted by Canadian securities regulators and Canadian stock exchanges.

The guiding philosophy and intent of the CIMVal Standards and Guidelines is that Mineral Property Valuations be carried out by appropriately qualified individuals and that all relevant information be fully disclosed.

The CIMVal Standards and Guidelines are organized into two parts:

- Standards – general rules that are compulsory

- Guidelines – elaborate on the Standards and provide guidance and best practices which are highly recommended

For more information about the Valuation Standards and Guidelines for Mineral Properties, click HERE.

CIMVal is currently co-chaired by Keith N. Spence and William E. Roscoe. The members of the CIM Mineral Property Valuation (CIMVal) Committee represent a mix of academic/professional disciplines and experience in the field of mineral property valuation:

Keith N. Spence (Co-chair), Global Mining Capital Corp.

William E. Roscoe (Co-chair), Roscoe Postle Associates Inc.

Eden M. Oliver (Secretary), Bennett Jones LLP

Carlos da Costa, University of British Columbia / Simon Fraser University

Michael G. Fowler, Loewen, Ondaatje, McCutcheon Ltd.

Marc Legault, Agnico-Eagle Mines Ltd.

Bruce McKnight, Bruce McKnight Minerals Advisor Services

Derek R. Melo, KPMG LLP

Michael R. Samis, Ernst & Young LLP

David A. Scott, CIBC World Markets Corp.

Pat Stephenson, AMC Mining Consultants (Canada) Ltd.

THE HISTORY OF THE CANADIAN VALUATION STANDARDS & GUIDELINES (CIMVAL)

INTRODUCTION

In January 1999, following the Bre-X ‘gold salting’ fiasco, the Mining Standards Task Force (MSTF) of the Toronto Stock Exchange and the Ontario Securities Commission in its final report specifically recommended that CIM form a “committee of valuation practitioners to review and advise on approaches to valuation of mineral properties” (page 84, section 8.2).

Subsequently on May 5, 1999, at the Calgary Annual General Meeting of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM); Keith Spence proposed that CIM establish a committee to establish standards and guidelines for the valuation of mining projects. The first motion was moved by Keith Spence (then Chairman of the Mineral Economics Society) and seconded by Sandy (A.M.) Laird (then President of CIM) approved the formation of a Special Committee on Valuation of Mineral Properties (CIMVAL) “to be co-chaired by Keith Spence and Dr. William Roscoe”.

The second motion, moved by Keith Spence and seconded by Sandy (A.M.) Laird specified operational aspects of the committee, and outlined in part: “the committee include a mix of geographical representation and professional disciplines. The Committee will report directly to CIM Council and be administered through the Mineral Economics Society. The mandate of the Committee will be to investigate the various methodologies and practices in the valuation of mineral properties and recommend a Canadian code and/or guidelines for the valuation of mineral properties.”

The Co-Chairs then set about to select individuals for the committee. The members selected for the inaugural committee were:

- Michael Bourassa, Aird and Berlis (Secretary, Mining Regulatory Lawyer, Toronto)

- Craig Roberts, First Marathon Securities (Investment Banker, Former Chairman of the Mineral Economics Society, Vancouver)

- Christopher Lattanzi, P.Eng, Micon International (Mining Consultant with experience in Valuation, Toronto),

- Ross Lawrence, P.Eng., Watts, Griffis McOuat (Mining Consultant with experience in Valuation, Toronto),

- Ian S. Thompson, P.Eng., Derry Michener Booth and Wahl (Geologist with experience in Valuation, Vancouver),

- Paul Lunney, MBA., Noranda Inc (Mining Engineer, Former Chairman of the Mineral Economics Society, Toronto)

- David A. Scott, CIBC World Markets, (Investment Banker, Toronto)

- Willoughby A. Trythall, (Former Placer Dome executive, Vancouver)

PROCESS OF DEVELOPMENT OF CIMVAL

The CIMVAL Committee organized a “Valuation Day” on March 8, 2000, at the CIM Annual General Meeting in Toronto, which was held jointly with the Prospectors and Developers Association of Canada (PDAC), named “Mining Millennium 2000”. Various industry experts presented papers on the valuation of Mineral Properties. A proceedings volume of the papers was subsequently published by CIM (copies of this book was commonly called the gold book because of its gold colour and was made available at CIM Head Office in Montreal for sale, and subsequently sold out).

In the spring of 2000, the CIMVAL Committee published an “Initial Framework for Discussion” which categorized and listed various issues for initial consideration in devising valuation standards. Input and comments were solicited in CIM publications and by direct requests to numerous organizations and individuals with an interest in mineral valuation. 15 responses were received and were considered in a “Draft Discussion Paper” along with input from the CIMVAL Committee members.

A “Draft Discussion Paper” was released at the CIM Annual General Meeting in Quebec in May 2001. Again, comments and submissions were requested from all interested parties. The Draft Discussion Paper set out the CIMVAL Committee’s preliminary views, opinions and unresolved questions on the issues involved in establishing a set of Standards and Guidelines for Valuation of Mineral Properties. 20 responses were received and were carefully considered in the “Draft Standards and Guidelines for Valuation of Mineral Properties”, released in February 2002.

On March 9, 2002, CIM Council adopted and approved the “Draft Standards and Guidelines for Valuation of Mineral Properties”, subject to any material changes in the final document being brought back to the CIM Council for adoption and approval. The CIMVAL Committee called for comments and submissions from all interested parties on the Draft Standards and Guidelines for Valuation of Mineral Properties. The CIMVAL Committee received 39 submissions by April 30, 2002. Because some significant issues were raised in the submissions, the CIMVAL Committee produced a “Revised Draft Standards and Guidelines” in September 2002 which was again distributed for comment.

A further 17 submissions were received by November 29, 2002, with respect to the “Revised Draft Standards and Guidelines”. The committee evaluated and considered all submissions during the course of several meetings in December 2002 and January 2003; and prepared a CIMVAL STANDARDS AND GUIDELINES (FINAL VERSION) FEBRUARY 2003.

CIM Council adopted and approved the FINAL VERSION on March 9, 2003. Later that year, the Toronto Stock Exchange (Venture) referenced CIMVAL in its Appendix G regulations.

BRIEF OVERVIEW OF CIMVAL

The key objective was to develop a working document containing a Canadian code and guidelines by which Canadian valuation practitioners will be required to follow in the process of valuing a mineral property. Additionally, a key focus is that the committee will focus on the valuation of mineral properties as assets, not on the valuation of companies holding these assets. For purposes of clarification, Valuation in the CIMVAL Standards and Guidelines is concerned with the value or worth of a mineral property as opposed to “Evaluation” where the key objective is an economic assessment or determination of the economic merit of a mineral property.

The guiding philosophy and intent of the CIMVAL Standards and Guidelines are that Mineral Property Valuations be carried out by appropriately qualified individuals and that all relevant information be fully disclosed. The Standards and Guidelines are based on industry best practices and allow for professional judgement in certain instances.

In addition, valuation should be stage based. The approach used to value a mineral property or mining project will depend on the development stage of the property.

The CIMVAL Standards and Guidelines are organized into two parts. The first part consists of Standards which are general rules that are mandatory in the Valuation of Mineral Properties. The second part contains Guidelines which elaborate on the Standards and, while not mandatory, provide guidance and best practices which are highly recommended to be followed in the Valuation of Mineral Properties. Definitions are included in the Standards. Where practical, terms are defined in a manner consistent with National Instrument 43-101.

VALUATION APPROACHES AND METHODS

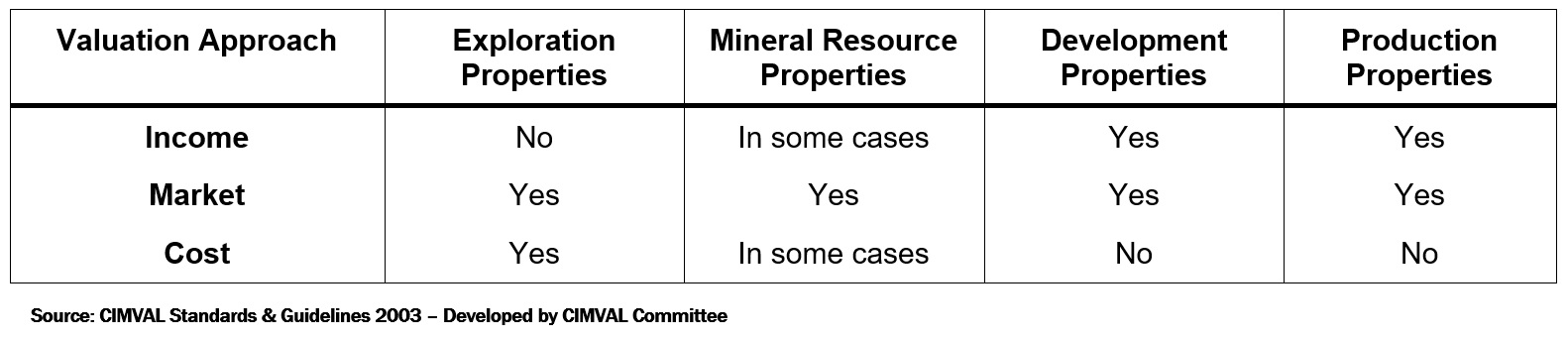

There are three generally accepted valuation approaches for mineral properties. These are the Income Approach, the Market Approach and the Cost Approach:

The Income Approach: is based on the income-producing capacity of an asset such that the asset value is measured by the present value of the “net economic benefits (cash flows)” received over the life of the asset. The present value of these benefits is calculated by adjusting the net economic benefits for the value impact of time and investment risk.

The Market Approach: also known as the “Sales Comparison Approach”, is based on the principle of substitution. An asset being valued is compared with the attributed transaction value of similar assets, transacted in an open market. Methods include comparable transactions, market capitalization analysis and option or farm-in agreement terms analysis.

The Cost Approach: is based on the principle of “Contribution to Value”. The appraised value method is commonly used where exploration expenditures are analyzed for their contribution to the exploration potential of the mineral property and may be adjusted for market conditions.

Development stages of the property:

The approach used to value a mineral property or mining project will depend on the development stage of the property. Mineral properties are categorized as:

-

- Exploration Property: A property that may have a mineral occurrence due to its location or initial exploration work highlighting a possible geological anomaly.

- Mineral Resource Property: A property that has been subject to enough exploration work to delineate mineral resources in an industry-recognized resource category such as inferred, measured or indicated.

- Development Property: A property that is being developed for future mining operations.

- Production Property: An operating mine.

Typically, the Income Approach is only considered for properties with sufficient exploration and technical work to prepare a life-of-mine model that details future metal production, capital costs, operating costs, taxes and other payments that can form the basis for cash flow projections. The information requirements for the income approach restrict its use to production and development properties and qualifying mineral resource properties.

The Market Approach can be used for all stages of the development of mineral properties or mining projects.

The Cost Approach is typically used to estimate the value of early-stage projects such as exploration properties and mineral resource properties with insufficient information for the Income Approach to be used.

CIMVAL developed a Valuation Chart which summarizes the stage of development of the project, and the appropriate approach that should be utilized. This Chart is now recognized as an industry standard and quoted in several published works, and presentations.

THE CIM VALUATION CHART: Valuation Approaches for Different Types of Mineral Properties

CIMVAL UPDATED IN 2019

After several years of review, CIMVAL was updated and adopted by CIM Council on November 29, 2019. The update process involved an Exposure draft which was issued to the public in June 2019. Subsequently, 13 public submissions were received and the CIMVAL Committee held various consultations with regulatory bodies such as the Canadian securities regulators (CSA) and the Toronto Stock Exchange (TSX). Key changes in the updated document include:

- Name change to “Code” from “Standards” to be consistent with other international valuation codes

- Format and structure follow International Mineral Valuation Committee (IMVAL) Template; with many references to International Valuation Standards (IVS)

- Section 2 Standards – provide more detail on key elements

- Principles of Competence, Materiality, Reasonableness, Transparency, Independence, and Objectivity

- Scope of work and limitations

- Mineral Reserves and Mineral Resources

- Responsibilities and Qualifications of the Qualified Valuator

- Provision for Short Form as well as Comprehensive Valuation Report

- Section 3 Guidelines – updated but similar to 2003

- Section 4 Definitions – more comprehensive than 2003

CIM – Standing Committee on Valuation – motion #1 – motion only – April 23, 1999

CIM – Standing Committee on Valuation – motion #2 – members only – April 23, 1999

CIMVAL – Founding Email – 1999