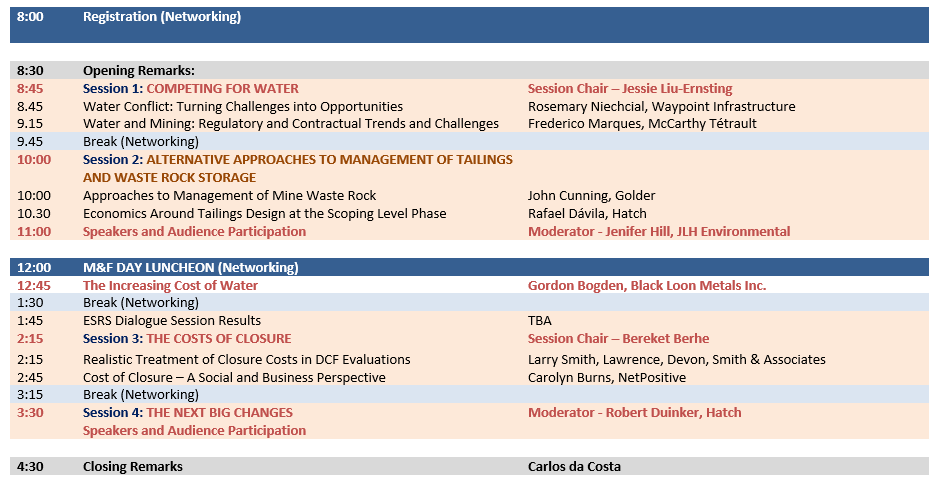

The tenth annual Management & Finance Day, organized by the Management and Economics Society of CIM, will feature expert speakers sharing their experiences and insights around key topics driving the industry.

Date: Wednesday, May 9, 2018

Ticket: included for convention delegates or $425 for a one-day program ticket (which includes lunch)

THE NEXT BIG CHANGE: THE ECONOMICS OF WATER, WASTE AND CLOSURE

KEYNOTE SPEAKERS TITLES, ABSTRACTS AND BIOS

Session: Competing for Water

Rosemary Niechcial

Scheduled: Wednesday, May 09 at 8:30 AM

Bio: Rosemary Niechcial is the managing director of Waypoint Infrastructure Inc., an infrastructure consulting firm created by water and power experts to assist mining companies to implement cost-effective infrastructure for the mining sector. Rosemary is a licensed professional engineer specializing in water treatment infrastructure and has experience working with mining companies to plan and negotiate alternative delivery models in the Americas, Australia, Europe, and the middle east.

Title: Water Conflict: Turning Challenges into Opportunities

Abstract: When a mine must source or discharge water off-site, the likelihood for conflict with local communities, agriculture, government, and other industries is high. However, there are significant opportunities to create partnerships, share risks, and reduce the costs of managing water. Through focused planning and deliberate development of contract models, mining companies can turn what has historically been a thorn in their side into a tool for social license to operate, access to more cost-effective financing, and a more streamlined mining operation. This presentation will touch on some of these opportunities and provide some case studies to illustrate these possibilities.

————————————————————-

Frederico Marques

Scheduled: Wednesday, May 09 at 9:15 AM

Bio: LLM and PhD in International Law, Partner at McCarthy Tetrault LLP

Title: Water & Mining: Regulatory and Contractual Trends and Challenges

Abstract: Having proper access to water, meeting quality and quantity requirements are key to develop mining operations. Countries with regions under water stress and great geological potential suffered and dealt with water issues by regulating the use of water. Companies are also developing creative ways to operate in areas under water stress, from construction of desalinization plants, to special contractual arrangements sharing infrastructure and access to groundwater. This presentation will discuss regulatory and contractual trends and challenges in dealing with efficient water use in certain Latin American countries and Canada.

Session: Alternative Approaches Management of Tailings and Waste Rock Storage

John C. Cunning

Scheduled: Wednesday, May 09 at 10:30 AM

Bio: John Cunning, P.Eng. is a Principal and Senior Geotechnical Engineer in the Golder Associates Vancouver office and has over 25 years of experience as a geotechnical engineer working on projects related to mine tailings facilities and mine waste management. John has a Bachelor degree in Civil Engineering (1991), a Master’s degree in Geotechnical Engineering (1994) both from the University of Alberta, where his thesis research was in the area of tailings liquefaction. He is a registered Professional Engineer in British Columbia, Northwest Territories and Nunavut. John has been involved in tailings, mine water management and mine waste projects ranging from site selection, geotechnical field investigations, laboratory testing programs, conceptual to detailed design, construction and closure. He has a number of roles as engineer of record for tailings facilities, and continues to be involved with design, operation and closure of mine waste dumps. Mr. Cunning is co-editor of the book Guidelines for Mine Waste Dump and Stockpile Design published in April 2017.

Title: Approaches to Management of Mine Waste Rock

Abstract: Mining a resource generates mine wastes, including overburden, rock and tailings, which are required to be managed in nearby storage facilities. Many mines produce water that needs to be managed in water management facilities; the mine’s processing plant also requires water to process the resource, and much of this water becomes part of the tailings waste stream. Management of mine waste rock and mine water can be big costs to a mining project. Open pit mining can generate large waste rock facilities and the designs for mine waste rock facilities should be carried out in stages along with the all the other components that make up the project. Design of a mine waste rock facility needs to consider site geology, geotechnical and hydrogeological conditions, with the design confidence being improved as level of study and level of knowledge increases with project stage. As much as possible, designs should be advanced such that the management of waste rock can provide benefits or cost savings to the project. This should be possible when mine waste management planning is integrated with mine planning and development by considering how the project can make best use of waste rock, tailings, or site water throughout operations. Emerging technologies, such as co-disposal of waste rock with the tailings stream, may provide further benefit to project economics through the reduction of environmental impact and geotechnical liability. After mining is complete, the site will be closed, and while closure is often far along in the project timeline, decisions in the design of mine waste management made even at the conceptual stage can be reduce closure and surety costs, leading to improved project economics. This presentation will discuss approaches to the management of mine waste rock as part of an overall mining project study as it relates to project economics.

————————————————————-

Rafael D’Avila

Scheduled: Wednesday, May 09 at 11:15 AM

Bio: Rafael D’Avila is Hatch’s Global Director for the Tailings and Mine Waste Management Practice and he is based at the Mississauga, Ontario office. Rafael has worked in consultancy for the mining sector for over 25 years in the mine waste management practice while occupying operations management roles. He is quite knowledgeable of the environmental and geotechnical conditions to be encountered in mining projects located in locations ranging from the Andean cordillera, the Mexican Sierras, the Russian tundra to the Brazilian and Canadian Precambrian shields. Up to this point in time, he has had thorough participation in studies and designs of tailings deposits, heap leach facilities and mine waste rock storage facilities that included site selections, subsurface investigations, deposition planning, mine water management, construction quality control and assurance, operation, remediation and closure studies of facilities associated with first class mining operations in the Americas and Russia. Rafael holds civil engineering and business management degrees from the Ouro Preto School of Mines in Brazil and the University of Alberta in Canada and is registered as a professional engineer in Canada (Ontario), Peru and Brazil (Minas Gerais).

Title: Economics Around Tailings Design at the Scoping Level Phase

Abstract: Most likely the directors of a mining company will be surprised when they hear for the first time about the result of a cost estimate exercise at a conceptual level for a Tailings Management Facility (TSF). After the Owner’s team initial wail -especially if it is an unsophisticated team-, the work of explaining follows and the walk through the CapEx, the Sustaining CapEx -if prepared- and the OpEx starts. The consultant´s work task of cost estimating comes only at the end of a scoping study and becomes probably the most difficult one because all project aspects are still in flux. It is part of a sequence of reality checks because, until that point, the mining company had been mostly focused on the front end with the business case of ore reserves and a mining plan that might be in a very incipient form. It becomes easier for them to digest the cost estimate of the mineral processing because there isn’t really a choice when it comes to recovery, but will inevitably have an issue with tailings and mine waste management because simply all “those savings” upstream of the tailings box or the primary crusher will sink at the TSF and its closure. Of course, this is not true for every mineral or metal project and becomes less frequent with a more sophisticated project team. However, it will still happen for those involved in the exercise. Also, there will be less baffled faces if the Owner’s project team is more seasoned and, especially, if their members are experienced in closing mines (even for care and maintenance). For obvious reasons, the exercise becomes more troublesome for the mining juniors because conceptual studies are crucial in market processes such as the NI 43-101 PEA given the intended audience. Decreasing the project’s cut-off cost and making it more attractive to the market is a must. It is at that point that the consultant’s cost estimator has only one way to reduce the estimate and that is to go back to the drawing board and seek a cheaper way of managing tailings, sometimes at the expense of the involved dewatering technology or the perceived risk of the selected site. This presentation will focus on how a consultant works with order-of-magnitude accuracy during a scoping study and how pit falls can be avoided to redo work in a tight schedule. A ballpark estimate is normally that first one to be produced for a TSF and is most likely based on the consultant’s experience at similar projects. It is based on very little information and, as a result, AACE Class 5 cost estimates range from -50% to +100% as they rely much more on judgement or analogy (almost an act of faith) than on factored capacity or parametric modeling, which happens to benefit the mining practice and mineral processing practice cousins at the same level. Every change in the cost estimate is a balancing act of finding an economic and pragmatic integrated solution for a TSF’s potential progressive closure -a less costly future scenario- while avoiding environmental and social pressures that a mining company might face with surrounding communities during the expected permitting phases of the project.

Session: The Cost of Closure

Carolyn Burns

Scheduled: Wednesday, May 09 at 2:15 PM

Bio: Carolyn is interested in how large organizations interact with people. She specializes in designing and facilitating systems to manage complexity with diverse groups. Carolyn is currently the Director of Operations at NetPositive, a non-profit collaborative research organization that is focused on the social outcomes of extractive development. She is also the Executive Director at the Devonshire Initiative, a members association of mining companies and international development organizations that focus on the social agenda of mining. Prior to these roles, Carolyn worked with the Barrick Gold Corporate Community Relations team and supported the development and implementation of management systems for the company and sites around the world. She has a Masters in Business Administration from the Schulich School of Business, a Graduate Certificate in Community Relations in the Extractive Sector from Queen’s University and a Honours Bachelor of Arts from McGill University.

Title: Cost of Closure – A Social and Business Perspective

Abstract: The mining industry has a poor reputation for mine closure. While environmental issues have traditionally been the focus of this poor reputation, social impacts are coming to the fore and will be a primary focus of mine closure in the future. It is well understood that the lack of community support can lead to permitting and operational delays in the development stages. But unresolved social issues at the end of a mine’s life can increase closure related costs and led to a negative reputation for the company and industry. This presentation introduces the concept of social closure, a process that ensures that a mine site can be closed in an efficient and effective manner, while managing the expectations and impacts of closure on local communities, governments, and the public. This presentation will also reference innovation methods for social closure that will mitigate costs and contribute positive outcomes for the local communities such as employment opportunities, alternate land use and infrastructure. Some of the questions we will consider include: What is social closure? What costs and impacts stem from poor planning and management of closure? How can a collaborative and well executed social closure plan actually add value to a mine or a mining company? Can we turn closure from a liability to a benefit?

————————————————————-

Lawrence Devon Smith

Scheduled: Wednesday, May 09 at 2:45 PM

Bio: Lawrence Devon Smith is Principal Consultant at LDSA. He is a mining engineer with over 40 years of experience in economic evaluations and project engineering for mining, metallurgical, and industrial projects. He holds a B.A.Sc. from the University of Toronto and an M.Eng. Mining from McGill University. Larry has worked as Director Project Evaluations at Barrick Gold and has held similar positions with BHP-Billiton Base Metals, Rio Algom, SNC-Lavalin, Kilborn, Inco, and Vale. His evaluation experience includes economic evaluations, targeting and ranking studies, scoping studies, optimization studies, pre-feasibility and feasibility studies, risk assessment, and due diligence work for banks and mining companies. Larry has published a number of papers on mineral project evaluation, discount rates, and risk assessment, and is considered an expert in these fields. Larry teaches mineral project evaluation and mineral economics at the University of Toronto, Schulich School of Business at York University, as well as in-house courses and seminars. He also presents “Introduction to Mining” workshops for investors, management, finance personnel, lawyers, and indigenous peoples. Larry has been on the executives of CIM Toronto and the CIM Mineral Economics Society (MES). He is the recipient of the CIM Robert Elver award for Mineral Economics, and is a Fellow of CIM and a CIM Distinguished Lecturer.

Title: Realistic Treatment of Closure Costs in DCF Evaluations

Abstract: In traditional DCF calculations the true cost and significance of closure costs are minimized, almost to the point of being irrelevant. This treatment belies their actual and growing importance in project and corporate planning, as well as their role in social and environmental obligations and corporate reputation. In other words, closure responsibility is a big deal that is not reflected realistically in our DCF math. This paper examines the math and proposes a straightforward approach to properly incorporate closure costs in DCF evaluations, specifically to address the growing obligation to set funds aside for end-of-life costs and long-term post-operation monitoring and treatment costs.

Unscheduled

Robert Duinker

Invited by: Kenneth Thomas

Bio: Robert is a management consultant with fifteen years of engineering, management consulting and study management experience at Hatch with a deep understanding of developing models for operations, risks and investment returns. Rob is a leader in Hatch’s financial modeling community of practice at Hatch is well versed in the assembly of financial models to internationally recognized standards and has acted as the Economic Analysis Qualified Person (QP) for the economic analysis sections technical reports in the mining and metals sector. Robert regularly manages due diligence engagements, engineering studies, and project value improvement exercises and has the led financial and economic assessments for a wide variety of metals, energy and infrastructure projects around the world. Prior to joining Hatch’s Management Consulting practice, Robert was a mechanical design engineer for the metals and energy sector where he began his endeavours to help clients manage risks and create shareholder value through operational excellence and innovative thinking.

Title: Financial Analysis to Support Shareholder Value Creation in Commodity Industry Investments

Abstract: It is often said that the purpose of the company in a free market economy is to create long term value for its shareholders. From a financial value perspective, the accepted mathematical approach for investors to make this determination is whether a particular investment is generating a positive Net Present Value (NPV). A positive NPV is indicative that the investments are expected to yield greater returns than the Weighted Average Cost of Capital (WACC) required by the investors to finance an investment of that size, opportunity and risk profile. NPV is an efficient way for companies to evaluate investment options on a time consistent basis to determine whether an investment “makes money” or creates value and provides a scale representation of the value created by the enterprise. The NPV on its own, however, does not convey the assessment of risk (commodity risk in particular) very well, as it represents a single value for a single cash flow scenario based on a single set of assumptions, and that forecast has risks that may impact the outcome. This is most true for the commodity industries, where selling prices fluctuate from the multitude of technological and market influences to supply and demand. A structured approach to evaluating projects considering multiple scenarios in the early stages of project evaluation is highly recommended to ensure that opportunities to improve value are captured and risks are minimized in the selected path forward. Identifying a good path forward early in the study stages can add substantially to the project value as the costs to re-scope a project with poor economics increase in orders of magnitude at each stage of project study (scoping, pre-feasibility, feasibility and execution). The mathematical basis for the evaluation of NPV both in terms of the traditional approach using discrete cash flow steps at regular time intervals, but also with continuous time using the Laplace transform of the future cash flows. In addition, Internal Rate of Return (IRR) and Capital Effectiveness (dollar of NPV per dollar of capital at risk) and the Sharpe ratio (return/risk) of the investment are presented as important metrics to prioritize investments and assess optimizations that create value both by increasing return and reducing risk of the investment. Some methodologies for evaluating risk are discussed including traditional qualitative approaches as well as quantitatively using computer based Monte-Carlo calculations considering the risks to capital costs, operating costs and pricing. It is shown that for commodity price risk modeling, that geometric Brownian motion (GBM), the basis for the Black & Scholes (1973) model for options pricing, and GBM with mean reversion, can both be considered special cases of an integrated semi-martingale model for commodity price risk that is presented incorporating price volatility, the tendency for mean reversion, as well as the long run expected increase to commodity prices.

Location:

Vancouver Convention Centre

West Building, 1055 Canada Place

Vancouver, BC

V6C 0C3

Click HERE to register for the tenth annual Management & Finance Day.

To learn about the upcoming Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Convention, please click HERE.

Date: May 6 – May 9, 2018

Location:

Vancouver Convention Centre

West Building, 1055 Canada Place

Vancouver, BC

V6C 0C3

For more information on upcoming CIM MES events, click HERE to check our calendar.

Keep up to date by checking us out at: www.cimmes.org

Be part of an MES conversation, start a conversation or simply be informed – join us on LinkedIn! Click HERE to register!